Clark Wealth Partners for Dummies

The smart Trick of Clark Wealth Partners That Nobody is Talking About

Table of ContentsClark Wealth Partners for BeginnersLittle Known Questions About Clark Wealth Partners.9 Simple Techniques For Clark Wealth PartnersSee This Report on Clark Wealth Partners4 Easy Facts About Clark Wealth Partners ShownNot known Facts About Clark Wealth PartnersIndicators on Clark Wealth Partners You Need To KnowClark Wealth Partners Fundamentals Explained

Whether your objective is to make the most of lifetime providing, ensure the care of a dependent, or support philanthropic reasons, calculated tax obligation and estate preparation assists secure your tradition. Spending without a method is just one of the most common mistakes when building wealth. Without a clear plan, you might catch panic offering, frequent trading, or portfolio misalignment.I've attempted to point out some that indicate something You really want a generalist (CFP) who may have an extra credential. The concept is to holistically consider what you're attempting to accomplish and all finance-related areas. Particularly due to the fact that there may be tradeoffs. The CFP would after that refer you to or collaborate with lawyers, accountants, etc.

10 Easy Facts About Clark Wealth Partners Described

These planners are in part salespeople, for either investments or insurance or both. I 'd stay away yet some people are comfortable with it. These coordinators obtain a fee from you, however as a percent of investment possessions took care of.

There's a franchise Garrett Planning Network that has this kind of planner. There's an organization called NAPFA () for fiduciary non-commission-based coordinators.

Clark Wealth Partners for Beginners

There have to do with 6 textbooks to dig through. You will not be a seasoned professional at the end, but you'll know a lot. To obtain a real CFP cert, you need 3 years experience on top of the courses and the test - I haven't done that, just guide knowing.

bonds. Those are one of the most crucial investment decisions.

How Clark Wealth Partners can Save You Time, Stress, and Money.

No 2 people will certainly have fairly the exact same set of investment approaches or services. Relying on your goals in addition to your tolerance for danger and the moment you need to seek those goals, your consultant can aid you identify a mix of financial investments that are suitable for you and made to assist you reach them.

A FEW THINGS YOU SHOULD KNOWAlly Financial Inc. (NYSE: ALLY) is a leading electronic monetary solutions company, NMLS ID 3015. Ally Financial institution, the firm's direct banking subsidiary, supplies an array of deposit product or services. Ally Financial Institution is a Member FDIC and, NMLS ID 181005. Credit scores products undergo authorization and additional terms use.

, is a subsidiary of Ally Financial Inc. The info included in this post is supplied for basic informational objectives and must not be construed as investment advice, tax obligation recommendations, a solicitation or offer, or a recommendation to acquire or market any kind of safety.

What Does Clark Wealth Partners Do?

Securities items are andOptions entail danger and are not suitable for all investors (financial company st louis). Testimonial the Characteristics and Dangers of Standard Options sales brochure before you begin trading alternatives. Options capitalists may shed the entire quantity of their financial investment or even more in a fairly brief time period. Trading on margin entails threat.

Clark Wealth Partners Fundamentals Explained

App Shop is a service mark of Apple Inc. Ally and Do It Right are authorized solution marks of Ally Financial Inc.

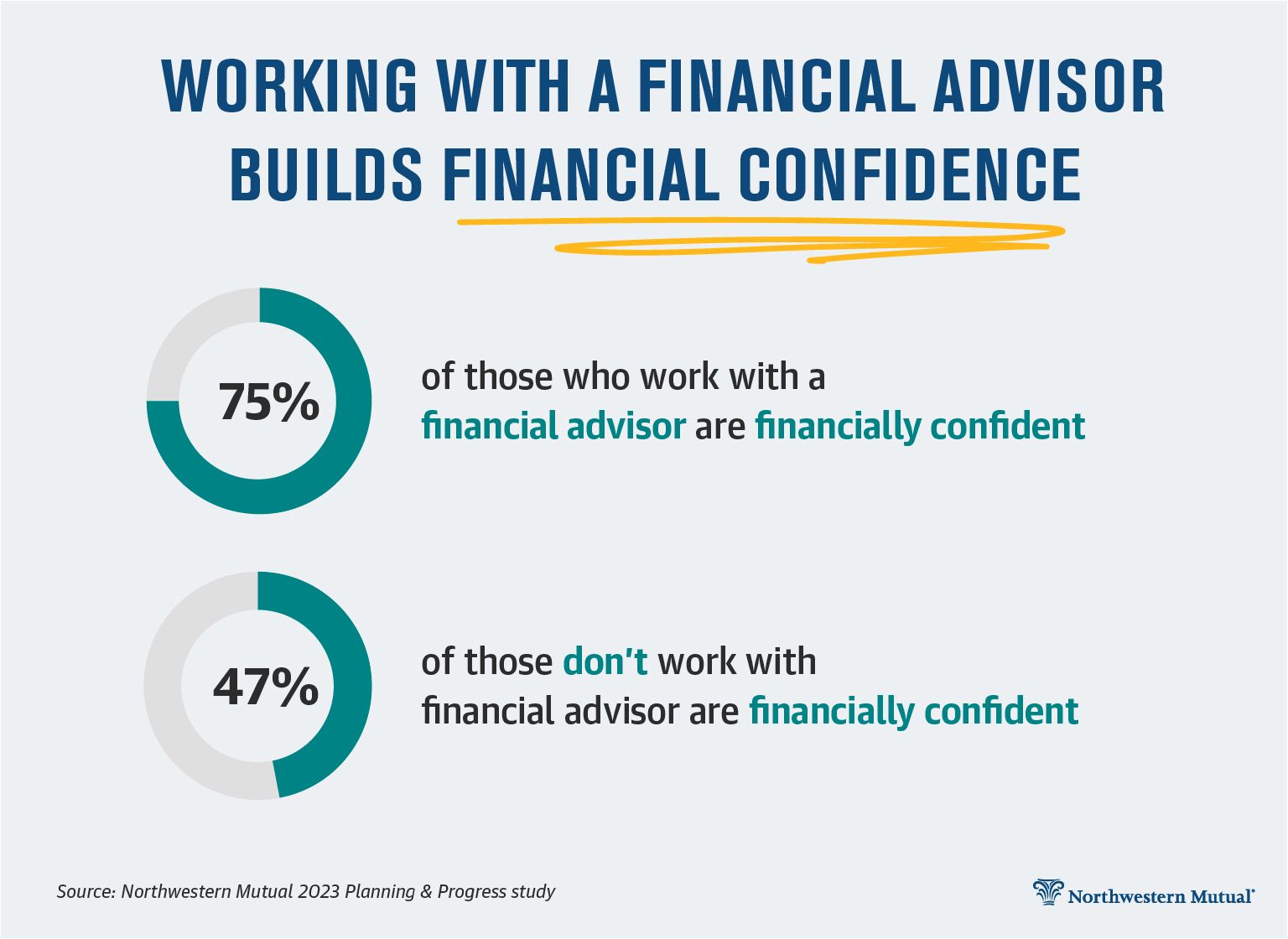

Managing your financial future can feel frustrating. That's where monetary advisors and economic organizers come inguiding you via every choice (retirement planning scott afb il).

The smart Trick of Clark Wealth Partners That Nobody is Talking About

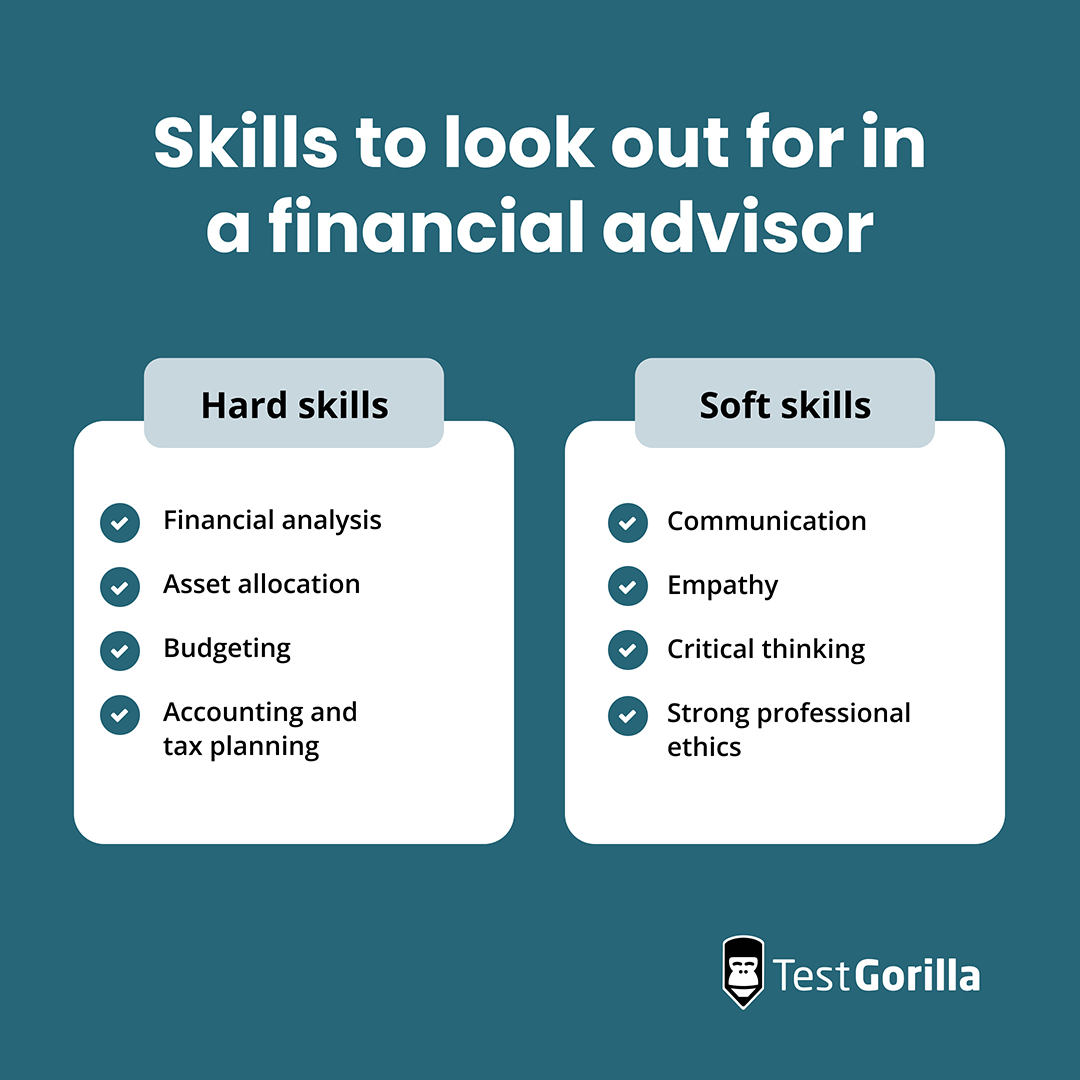

Market changes can create panic, and tension can shadow huge choices. A monetary advisor aids maintain you grounded in the everyday, while a financial organizer ensures your choices are based upon long-lasting objectives. Together, they are objective and help you browse volatile times with self-confidence as opposed to responsive emotions. Financial consultants and financial organizers each bring different capability to the table.

Do you intend to retire eventually? Perhaps obtain married or most likely to college? Just how around paying for some financial obligation? These are all reasonable and achievable financial objectives. For many of us, nevertheless, it's not always clear how to make these desires happen. And that's why it may be a good idea to get some expert aid.

See This Report about Clark Wealth Partners

While some experts offer a variety of solutions, numerous specialize only in making and managing financial investments. An excellent expert needs to have the ability to provide assistance on every aspect of your monetary situation, though they may focus on a certain location, like retirement planning or wide range management. Ensure it's clear from the get-go what the cost includes and whether they'll invest even more time focusing on any area.